There continues to be so much “breaking news” that I am starting to feel like Dash, in The Incredibles.

It can be very exhausting because you feel like you are on high alert all day long. Obviously, I could choose to not be on Twitter and live blissfully, but I am drawn to the drama. And, I follow the “Breaking News” so you won’t have to!

I am splitting this topic into 2 different newsletters. I want to avoid writing long newsletters. The 2 topics of tweets will be - Culture Wars and Public & Foreign Policy.

This newsletter covers the “Culture Wars” Tweets of the week.

Culture Wars’ Tweets

#1 - Inflation over everything else

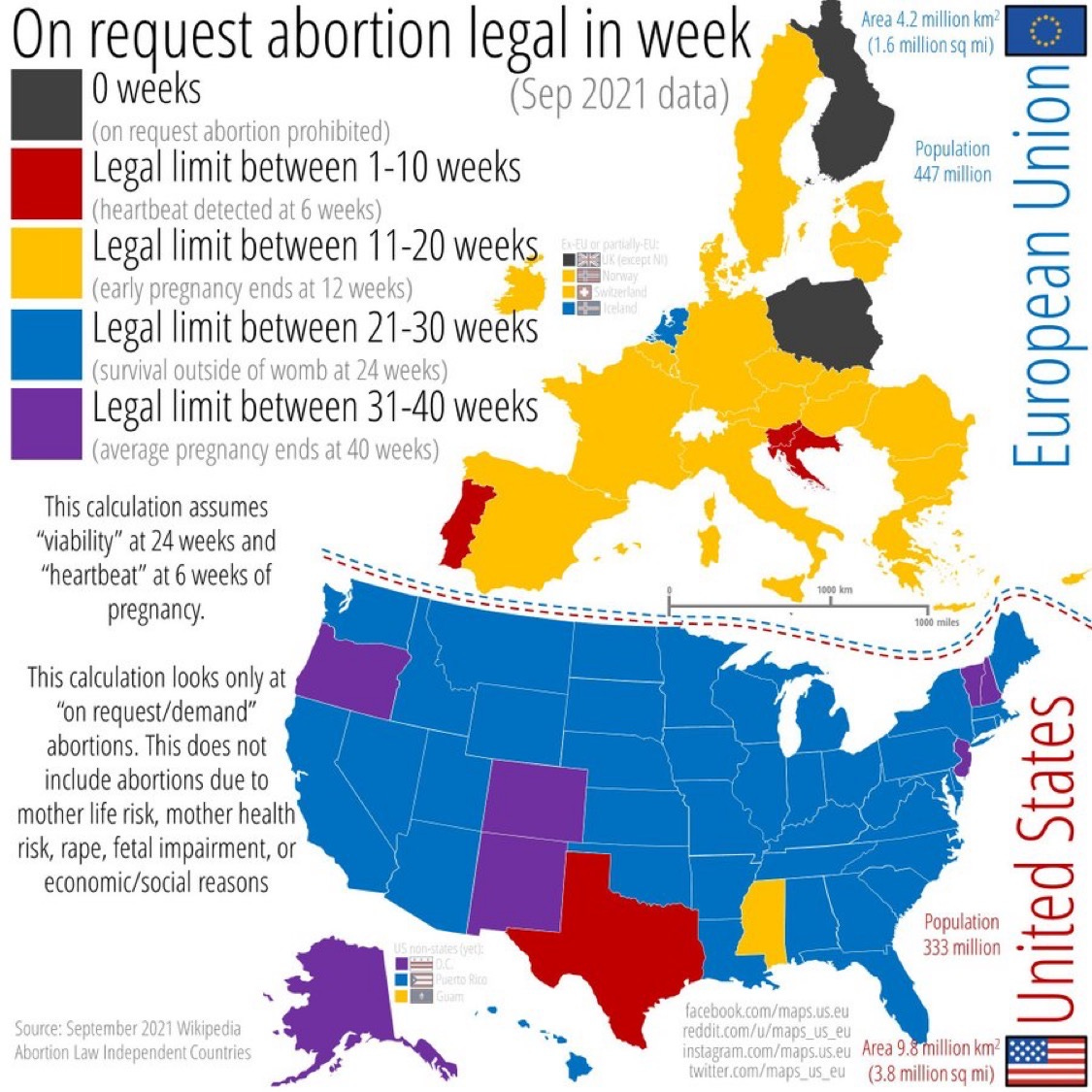

On Monday, May 2nd, Politico published a leak of a first draft opinion by the Supreme Court for the upcoming decision on Dobbs v. Jackson Women’s Health Organization. This article went viral, of course, and became a hot topic for the next 24 hours. The first draft looked to overturn Roe v. Wade, which would have the effect of sending the issue of abortion to the state legislatures. Below is an infographic, just to give some an idea of the breakdown of abortion laws in the US and compare it to the European Union.

It would surprise people to know that the US abortion laws are some of the most liberal in the world and shares company with countries like China and North Korea. Regardless, the real opinion has not been released so we really do not have any idea. I will wait to comment further until we know what is real.

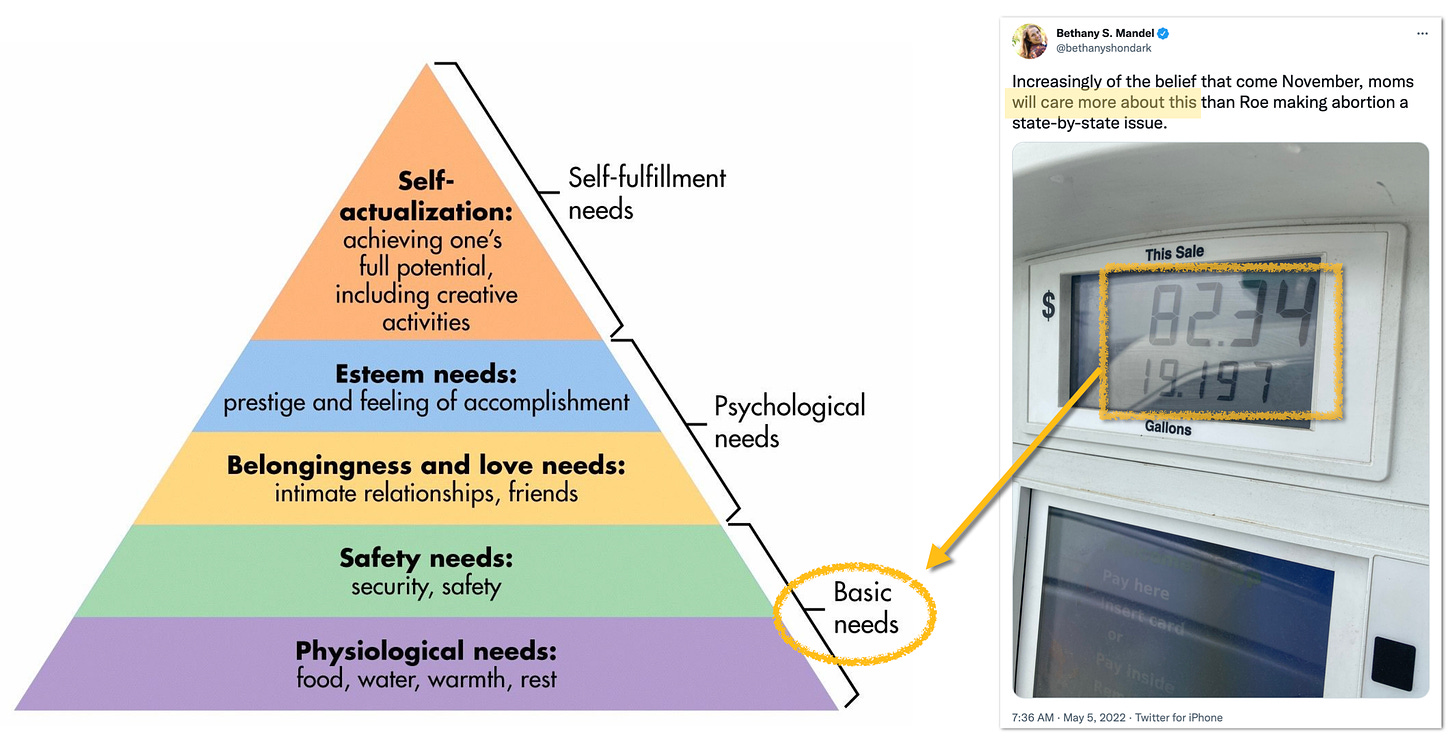

A couple of days later, Bethany Mandel, who lives in NYC, tweeted something that I totally identify with and believe to be true. Social issues (culture wars) take a back seat when people are struggling to provide for themselves and their families on a daily basis. It is the basic Maslow’s Hierarchy of Needs. I cannot tell if the Biden Administration and the Democrats understand how bad it is for many people right now.

#2 - Mama Bear tweet -

The New York Times (NYT) will not be out done by the Washington Post (WaPo). Therefore, they can write a hit piece of Elon Musk too! NYT tied Elon Musk to the apartheid and racism of South Africa’s past. Musk was born and raised in South Africa (in case you were trying to figure out why). He left South Africa for Canada in 1989. Details, schmetails.

My favorite tweet of this week comes from Musk’s totally gorgeous, former model mother - Maye Musk. Her tweet said so much in less than 140 characters. Her words speaks for itself so I will write no more on this one. Happy Mother’s Day!

#3 - ESG = the new woke push

This is becoming a new element in the culture wars1. ESG refers to Environmental, Social, and Governance criteria. Here is my translation of how this applies in real life. Growing demand by some investors that companies be rated based on the company's mission to …

clean the environment (environmental),

have diversity in their companies (social) and

make sure C-suite people behave and are not paid too much (governance)

This movement has been growing rapidly for the past 5 years. The largest fund managers (Blackrock and Vanguard) are behind the big push to have other companies pledge to make company decisions based on ESG standards. In reality, this distorts how capital is allocated. For example, let’s say I am an ESG conscious investor. I go to Peloton who tells me that

they are cleaning the environment by not being on the road with their stationary bikes,

they have diversity in the C-suite, and

they will not pay their CEO any bonuses

I look at their product and think… but they have one product that is a stationary bike with a tv that talks to me while I am riding it. No matter because Peloton’s ESG score is so high that I will invest with them and not another company that I am also looking with a low ESG score - Comcast - you know, the company that is going to bring 5G to just about everyone in the US. Therefore, investors are pressured to allocate capital towards a stationary bike company over a company that is trying to bring high speed broadband to remote parts of the US.

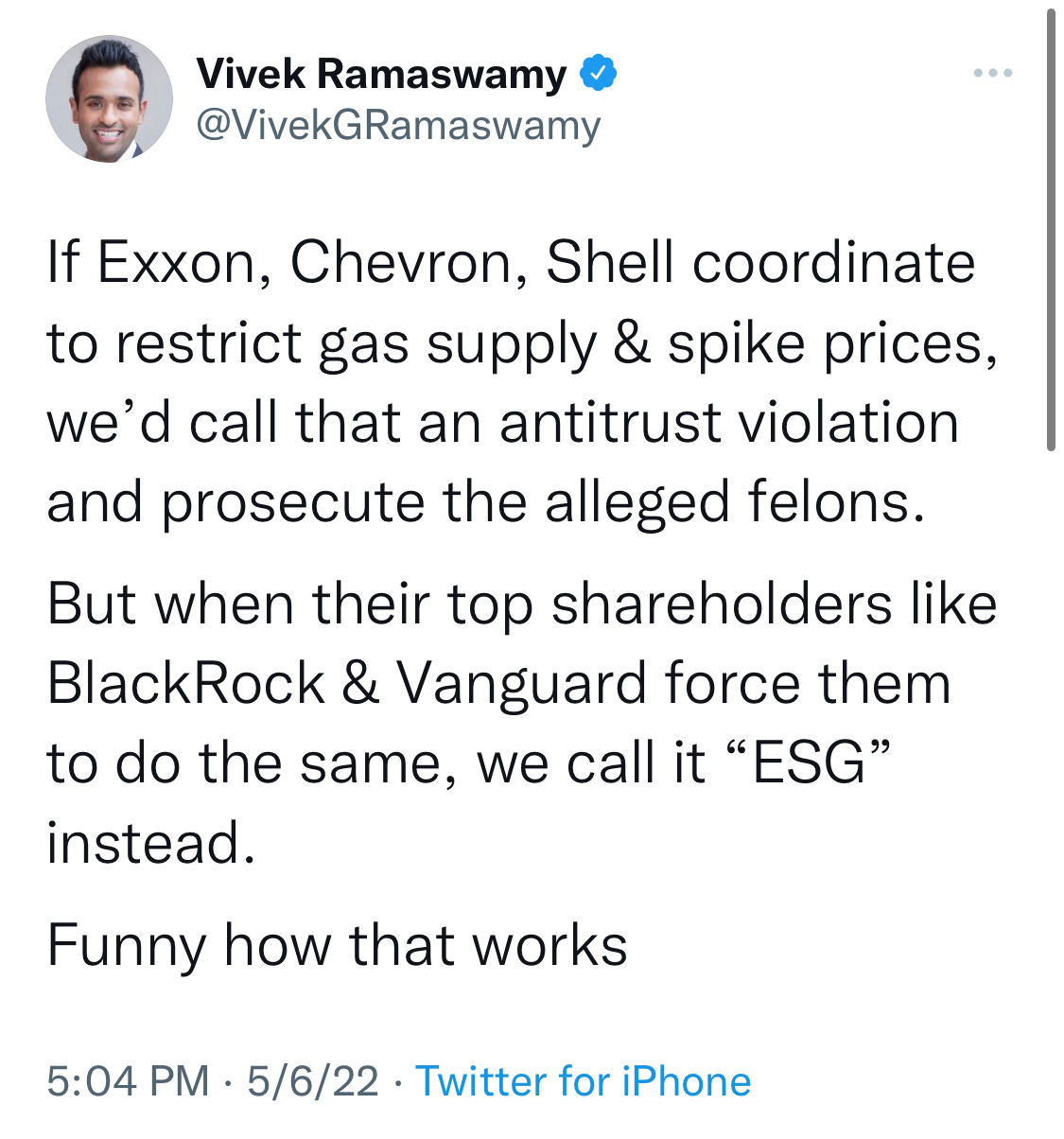

With that background in mind, here is a tweet from Vivek Ramaswamy who wrote an excellent book - Woke, Inc. and is coming out with another one in September.

His tweet is pointing to the growing idea that ESG investing has become an antitrust violation. A recent Wall Street Journal article explained it best -

“The biggest banks and money managers seek to implement a political agenda, such as compliance with the Paris Climate Accord. Then a group mobilizes: Climate Action 100+, for example, comprised of hundreds of big banks and money managers that together manage $60 trillion. The group uses its coordinated influence to compel companies to shut down coal and natural-gas plants. The activism can include pushing climate goals at shareholder meetings and voting against directors and proposals that don’t comply with the agenda, even if other decisions may benefit investors.”

The author of the article is the Attorney General of Arizona, Mark Brnovich, who used this article to explain why he has launched an investigation into this practice. Utah is done something similar by sending a letter to Standard & Poor’s (S&P) listing the problems with their ESG rating system. Utah is anticipating a possible future downgrade in their credit rating because “the ESG indicators are subjective and likely to be inappropriately influenced by political bias and trends.”

Fake ideas blow bubbles

It is not hard to see this happening. The “credit” rating is not based on credit worthiness (if someone pays the bills on time). Instead, it is based on what Blackrock believes to be ESG friendly. However, ESG does not assess if someone pays their bills on time.

This is how bubbles are created. The perfect example of this are subprime mortgages. There was a push back in the early 1990s by the federal government for more “affordable housing”. Thomas Sowell explains,

After HUD became a regulator of Fannie Mae and Freddie Mac in 1992, these government-sponsored enterprises were set numerical goals - quotas - for what share of their lending was to be for “affordable housing” mortgages. In practice, they were pushed to acquire more subprime mortgages.2

In the name of “fairness” and not “credit worthiness”, the amount of subprime mortgages began to grow along with rising home prices. After a decade of this practice, home prices started to fall in 2006 for the first time. In hindsight, that was the beginning of the Housing Bust.

What bubbles are being blown by ESG standards? Will those bubbles be popped with rising inflation, rising home mortgages rates and soon to be interest rates?

Those are the things I am watching for right now.

Sincerely,

Me

Culture wars are different social groups battling to have their values dominate. I talk more about this and how companies are playing a role in these culture wars in a previous newsletter.

Thomas Sowell, The Housing Boom and Bust, (2009), p. 58.

Thank you for chasing the drama so I don’t have to!